How Beginners Can Leverage Direct Hard Money Lenders Successfully

Wiki Article

The Crucial Guide to Picking a Tough Cash Lender for Your Next Task

Picking a hard money loan provider is an essential step for any capitalist. The best lending institution can substantially impact the success of a project. Aspects such as online reputation, car loan terms, and responsiveness are important in this decision. Understanding these components can bring about a smoother loaning experience. Nevertheless, several neglect important information that might affect their option. What should capitalists focus on to ensure they select the ideal lender for their demands?Comprehending Hard Money Lending

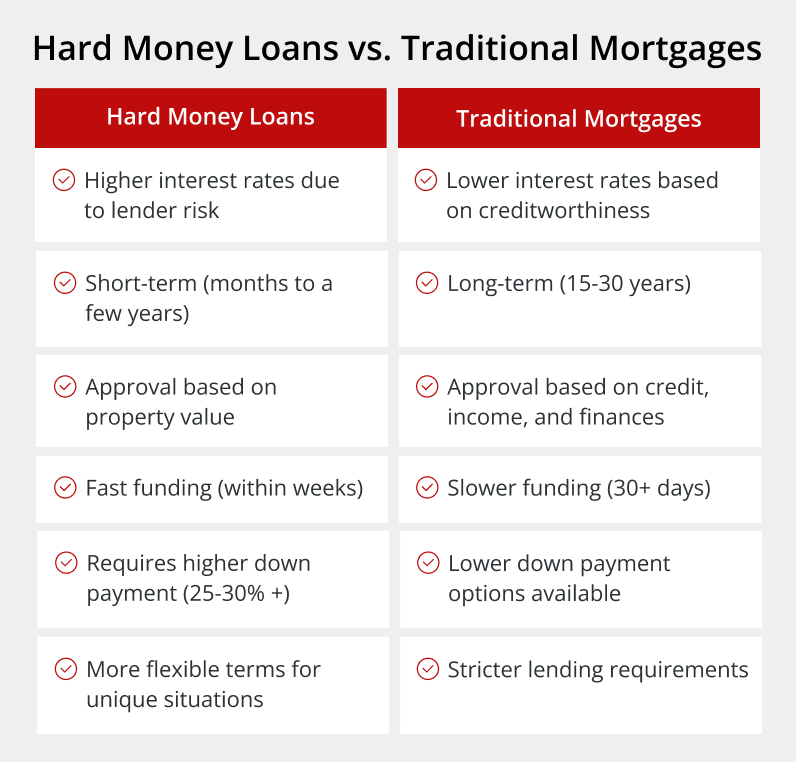

Tough money borrowing can appear frightening at first, it offers as an important option for debtors who might not qualify for conventional financing. This kind of funding is mainly safeguarded by actual estate, making the property itself the main consider the financing choice instead of the customer's credit report. Hard cash lending institutions normally use fast accessibility to funds, which is specifically advantageous for investors seeking to maximize time-sensitive opportunities. Lending terms are generally much shorter, typically ranging from six months to three years, with higher rates of interest reflecting the boosted risk taken by loan providers. Recognizing these basics can help debtors browse the landscape of Hard cash lending, acknowledging its duty in property financial investment and growth.Advantages of Collaborating With Hard Cash Lenders

Hard cash lenders offer distinct benefits for customers seeking quick access to funds. The faster financing procedure allows financiers to seize time-sensitive opportunities, while flexible car loan terms satisfy a selection of financial circumstances. These advantages make Hard money lending an attractive choice for those seeking immediate resources.Faster Funding Refine

When time is important, numerous capitalists transform to Hard money lenders for their expedited funding process. Unlike conventional financial institutions, Hard money lenders frequently need much less documents and can authorize Loans quickly, enabling capitalists to take possibilities prior to they vanish. The streamlined application procedure usually entails marginal bureaucratic difficulties, enabling faster decision-making. Hard money loan providers focus mostly on the value of the property rather than the consumer's credit reliability, which considerably speeds up the authorization timeline. This fast accessibility to funds is specifically helpful in affordable realty markets, where hold-ups can result in missed chances. By choosing Hard cash lending institutions, capitalists can act promptly, ensuring they remain ahead in their investment ventures.Flexible Finance Terms

How do versatile finance terms boost the allure of Hard cash lenders for financiers? Capitalists commonly discover that Hard cash lenders use adaptable loan terms tailored to their certain requirements, making them an appealing alternative for different jobs. These loan providers normally provide choices pertaining to settlement routines, passion rates, and funding amounts, enabling investors to align their financing with their cash money circulation and job timelines. This versatility can significantly profit actual estate capitalists seeking fast funding for improvement or procurement tasks. Furthermore, such terms can accommodate different danger accounts and investment strategies, making it possible for investors to pursue opportunities that conventional loan providers might forget. Eventually, versatile funding terms equip capitalists to make even more informed decisions and optimize their investment potential.Secret Elements to Think About When Choosing a Loan provider

Choosing the right Hard cash lender entails a number of vital factors that can greatly impact the success of a realty financial investment. One have to examine the lender's loan-to-value (LTV) ratio, as this determines the amount of funding available relative to the home's value. In addition, understanding the rate of interest and charges related to the loan is necessary, as these can influence total earnings. The rate of financing is an additional important consideration; a lender who can accelerate the financing process might be essential for time-sensitive projects. Checking out the terms of repayment, including period and adaptability, can help align the car loan with the investor's method. Clear communication and responsiveness from the loan provider can enhance the borrowing experience considerably.

Reviewing Lending Institution Online Reputation and Experience

A loan provider's track record and experience play considerable duties in the decision-making process for capitalists seeking Hard cash fundings. A well-regarded lending institution typically shows dependability and expertise, which can boost a capitalist's self-confidence. Testimonials and reviews from previous clients work as valuable sources for identifying a loan provider's trustworthiness. Direct Hard Money Lenders. Furthermore, the size of time a lender has remained in the organization can mirror their know-how and capacity to browse market changes. Experienced lending institutions are normally extra skilled at giving and assessing jobs customized services. Financiers should seek lending institutions who have a tested navigate to this website track document in funding comparable projects, as this experience can bring about smoother transactions and far better results. Ultimately, online reputation and experience are crucial signs of a loan provider's potential performanceContrasting Car Loan Terms and Prices

The Application Process for Hard Cash Loans

Maneuvering the application process for Hard money Loans can be uncomplicated if borrowers recognize the required steps. Potential borrowers need to gather important documents, including building details, financial declarations, and a comprehensive project strategy. This details helps loan providers evaluate the risk and prospective roi.Next, customers should recognize ideal Hard cash loan providers by researching their terms, prices, and online reputation. Once a lender is selected, applicants submit their documentation for testimonial. The lending institution generally performs a residential property appraisal to establish its value.

After the assessment, debtors might receive a lending proposition describing problems and terms. Upon contract, funds are paid out, enabling the borrower to wage their project. Clear communication throughout this process is important for a successful outcome.

Often Asked Concerns

What Kinds of Projects Are Finest Suited for Hard Cash Loans?

Hard money Loans are best suited for short-term tasks requiring quick financing, such as property flips, restorations, or urgent acquisitions. Capitalists frequently like these Loans for their versatility find out this here and rate contrasted to conventional funding options.How Quickly Can I Obtain Financing From a Hard Money Lender?

The speed of funding from Hard cash loan providers typically ranges from a few days to a week. Elements influencing this timeline include the lender's processes, the project's complexity, and the customer's preparedness with necessary paperwork.

Are There Early Repayment Penalties With Hard Cash Loans?

Asking about early repayment fines with Hard cash Loans reveals that several loan providers impose such fees. Terms differ significantly, making it vital for borrowers to assess funding agreements very carefully to recognize potential economic implications.Can I Use Hard Cash Loans for Personal Expenses?

Hard cash Loans are largely created genuine estate investments. Using them for individual expenditures is usually not advisable, as lending institutions typically expect funds to be alloted in the direction of property-related projects, limiting their usage for individual demands.What Takes place if I Default on a Tough Money Car Loan?

If a private defaults on a difficult money loan, the lending institution usually launches foreclosure procedures on the building securing the funding, causing possible loss of the possession and damage to the customer's credit score.Unlike Clicking Here conventional banks, Hard cash lenders often need much less documentation and can accept Loans promptly, permitting financiers to seize possibilities prior to they vanish. How do adaptable lending terms improve the appeal of Hard money lenders for financiers? Financiers usually discover that Hard cash lenders supply adaptable funding terms customized to their details demands, making them an attractive option for various jobs. Direct Hard Money Lenders. A lending institution's reputation and experience play significant roles in the decision-making procedure for investors seeking Hard cash finances. When reviewing Hard money lenders, contrasting lending terms and prices is vital for making informed monetary decisions

Report this wiki page